It has been a nervous month for the professionals working for internet and e-commerce companies in India. Shutdowns and layoffs have been the flavour of the month, and business models have come under scrutiny. The effects of recent events at Stayzilla and Snapdeal have not been limited to job losses only. Weighed down by these developments in the sector, Rakuten, the Japanese e-tailer, has puts its India plans on the back-burner.

Stayzilla, an alternate and homestay aggregator, has shut operations. Investors including Nexus Venture Partners and Matrix Partners have invested USD 33 million across multiple rounds in the company. The founders have promised to bounce back ‘with a different business model’.

Snapdeal, announced that it will lay-off about 600 employees from the company including from its Vulcan (logistics) and Freecharge (payments) business divisions. The company has so far raised USD 1.75 billion from investors which include global heavyweights such as Softbank, Kalaari Capital, Temasek, Alibaba Group and eBay. However, Snapdeal reportedly is left with less than enough cash to survive the next 12 months. The merger talks with Paytm, facilitated by the common investor Alibaba, are not murmurs anymore and seem to be the logical next step in many ways. A very honest and important insight on the business model emerged from this episode, in which the founders admitted to ‘doing too many things’ and ‘diversifying and starting new projects while we still hadn’t perfected the first or made it profitable’.

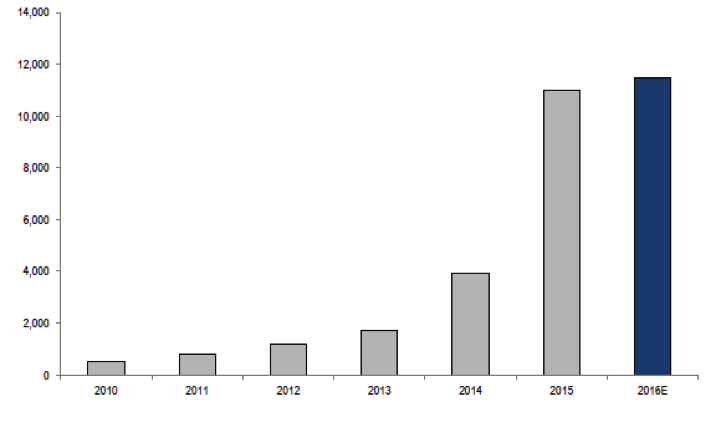

The above incidents highlight the fact that Indian e-commerce in 2016 has been significantly different from its ‘glory days’ in 2015. GMV growth in 2016 was flat, even though long term prospects remain intact for now. The year-end sales were also impacted due to the demonetisation exercise carried out by the government. The cash on delivery (CoD) transactions, which account for approximately 50% of total GMV, were severely impacted due to the lack of availability of the new currency notes.

Figure 1: India e-tailing GMV (USD mn)

Source: Company data, IAMAI, Euromonitor, Credit Suisse

GMV, as the supreme emperor of metrics, has lost its sheen and the challengers which have come to the fore include revenue per customer (function of number of orders per year, value per order and commission), net promoter score (a measure of customer satisfaction) and overall user monetisation (including alternative sources such as advertising as well as new service offerings such as hyperlocal services).

GMV, as the supreme emperor of metrics, has lost its sheen and the challengers which have come to the fore include revenue per customer (function of number of orders per year, value per order and commission), net promoter score (a measure of customer satisfaction) and overall user monetisation (including alternative sources such as advertising as well as new service offerings such as hyperlocal services).

The sustainability of business model is back in focus as a tool to evaluate potential winners and losers. Throwing money at the customers as discounts has not worked out very well for a lot of players. There has been a definite move towards trying to find other means of retaining customers. Going forward, winners are most likely to be companies that provide a differentiated customer experience. An obvious example is Amazon Prime which now brings more personalized experience to the company’s customers. Flipkart (Flipkart Assured) and Snapdeal (Snapdeal Gold) have similar offerings to enhance the stickiness of their customers. While ‘Flipkart Assured’ has seen limited success so far, Amazon Prime, launched at a very attractive price point of INR 499 per year, seems to be more suited for success going forward. Amazon has also clubbed its Netflix challenge – Prime Video offering with Amazon Prime subscription. With these offerings, the companies are trying to take focus away from discounts and towards customisation, quick delivery, consistency and reliability of shopping experience.

The control over supply side is a key element of constructing an enhanced and consistent experience for customers. Logistics is one of most prominent cost items for ecommerce firms, and depending on the category and value of the goods being delivered, could be 10% to 20% of GMV.

In India, the number of Amazon fulfilment centres has grown to 27 by the end of 2016. Shipping from stores is less efficient than from dedicated fulfilment centres. Amazon is looking to replicate their success in North America where they have invested billions in network of fulfilment centres. It has more than 75 such centres in North America, covering 25 US states. This gives Amazon an easy two-day reach over the entire US. Snapdeal has opened 6 logistics hub during 2016, with an estimated investment of USD 300 million. Paytm, flush with a USD 200 million funding from Alibaba, is reportedly firming up plans for a significant strategic investment in a logistics firm to improve its deliveries process.

The key growth drivers for e-commerce in India remain in place. There is a large aspirational population, faster and wider internet access, a never before push on digital payments and an opportunity to further penetrate the offline organised retail market. Nevertheless, the year 2016 has been a reality check. The Indian players have had to review their business models and take some tough calls to focus on sustainability. While the market may continue to be volatile in the short term, with more potential shutdowns and/or consolidation in the offing, we can now be more confident that the firms that do survive will turn profitable soon.

This is a guest post by Arvind Yadav,

Principal at Aurum Equity Partners LLP.